Our Approach to

Green Growth

Green Growth is essential for Indonesia’s future, driving economic progress while protecting the environment. Through strategic initiatives, ICGD supports Indonesia in achieving its 8% inclusive and resilient growth target.

Green Growth Areas 1:

Building Indonesia’s High-integrity Carbon Markets

Carbon markets mobilize domestic and international finance for climate action by enabling the trade of carbon credits, which represent the reduction or removal of greenhouse gas emissions. Credits are generated by companies or project developers and purchased by individuals, corporations, or governments to meet compliance obligations or make voluntary climate commitments.

Requires participants to pay for emissions above a certain limit by paying for emission quotas (allowances)

Corporate buyer

- Meet corporate climate commitments

- Demonstrate climate leadership and values

- Access financing for mitigation projects

Enables selling emissions reduction or removal carbon units (credits) to accelerate mitigation beyond value chains

Market

- Incentivise cheapest actions are invested first, reducing total cost of NDCS

Seller

- Sell emissions quotas as a source of revenue

Goverment

- Reduce gov’t expenditure

- Increase gov’t revenue from emission quotas auctioning

Agreement

(CA)

Enables the international transfer of emissions reduction or removal for international compliance and other purposes

International sov/.corporate buyer

- Meet international compliance with cheaper cost

Seller

- Unlock concessional and market financing making projects bankable and access int technological expertise

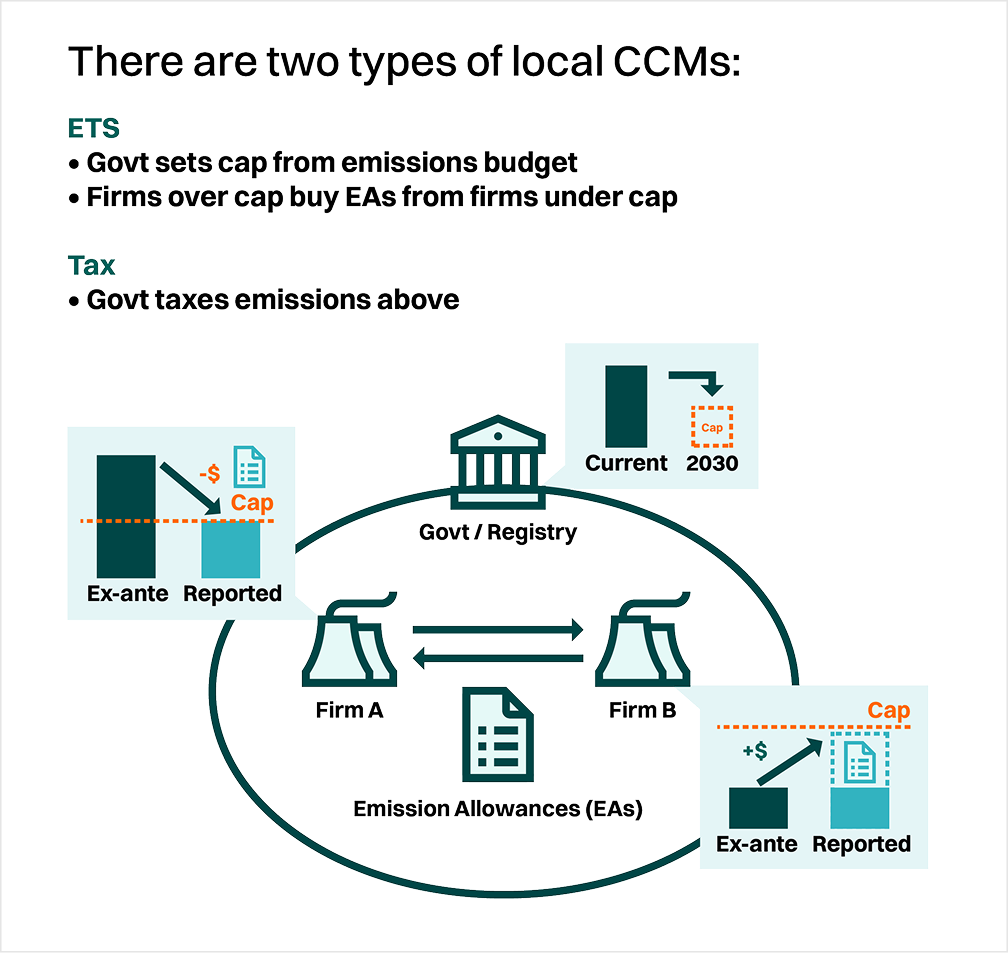

What are domestic compliance carbon markets?

Domestic compliance carbon markets are government-regulated systems designed to ensure that entities within a country meet legally mandated greenhouse gas (GHG) reduction targets. These markets make firms pay an explicit price on their carbon emissions from production. This enforces an opportunity cost for polluting firms to either invest in more sustainable manufacturing technology or to pay for the carbon they emit.

What is an emissions trading scheme?

An Emissions Trading System (ETS), often called a cap and trade scheme, limits the total amount of emissions allowed across covered sectors. The government allocates or auctions emission allowances to companies, each representing the right to emit one tonne of CO₂. Companies that reduce emissions below their allowance can sell their surplus to others, while those exceeding their limit must buy additional allowances or face penalties. Over time, the overall cap is lowered, tightening supply and increasing the carbon price. Notable examples include the European Union ETS, the Korean ETS, and California’s Cap and Trade Program.

What is a carbon tax?

A carbon tax is a direct tax levied by the government on the emissions of firms. Revenues generated can be used to support climate initiatives such as green infrastructure and ease the transition for affected communities. Examples include Sweden’s carbon tax and Singapore’s carbon tax.

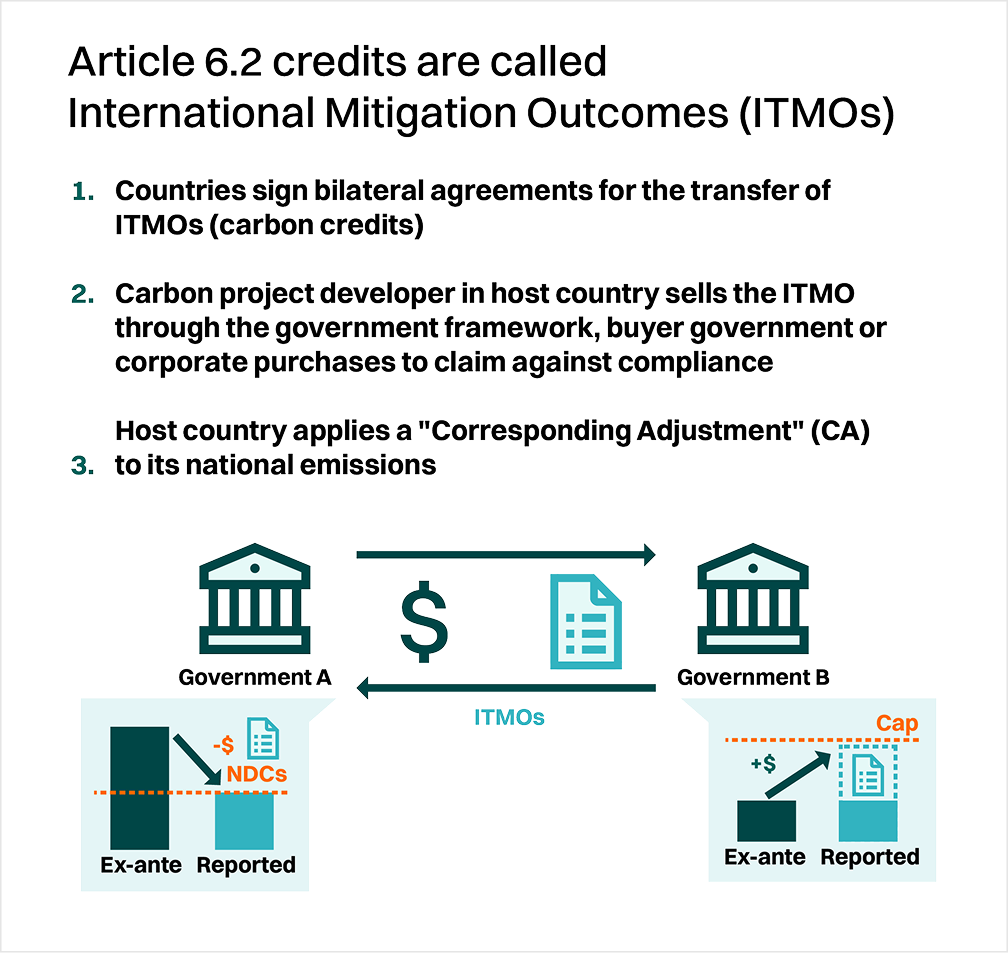

What are ITMOs under Article 6.2?

Article 6.2 of the Paris Agreement provides a framework for countries to cooperate directly through bilateral or multilateral arrangements to achieve their Nationally Determined Contributions (NDCs) or for other international mitigation purposes (OIMP). It allows countries to transfer Internationally Transferred Mitigation Outcomes (ITMOs) between one another, creating a flexible channel for cross-border carbon trading that can mobilise finance and promote more cost-effective emission reductions.

What is the process of establishing an Article 6.2 market?

The process of establishing an Article 6.2 channel typically begins with bilateral agreements or Memoranda of Understanding (MOUs) between participating governments, the host country that sells the ITMOs, and the buyer country that purchases the ITMOs. These agreements define the scope of cooperation, eligible mitigation activities, accounting procedures, and how transferred mitigation outcomes will be tracked and reported. Participating countries must also develop national authorisation and registry systems to issue, track, and manage ITMOs.

How does Article 6.2 prevent double counting?

A key safeguard under Article 6.2 is the requirement for corresponding adjustments (CAs), which ensure that emission reductions are counted only once between participating countries. When a host country transfers an ITMO to another country, it must adjust its emissions balance upward by the same amount (the application of CA), while the acquiring country adjusts its balance downward. This prevents double counting and preserves the environmental integrity of the mechanism.

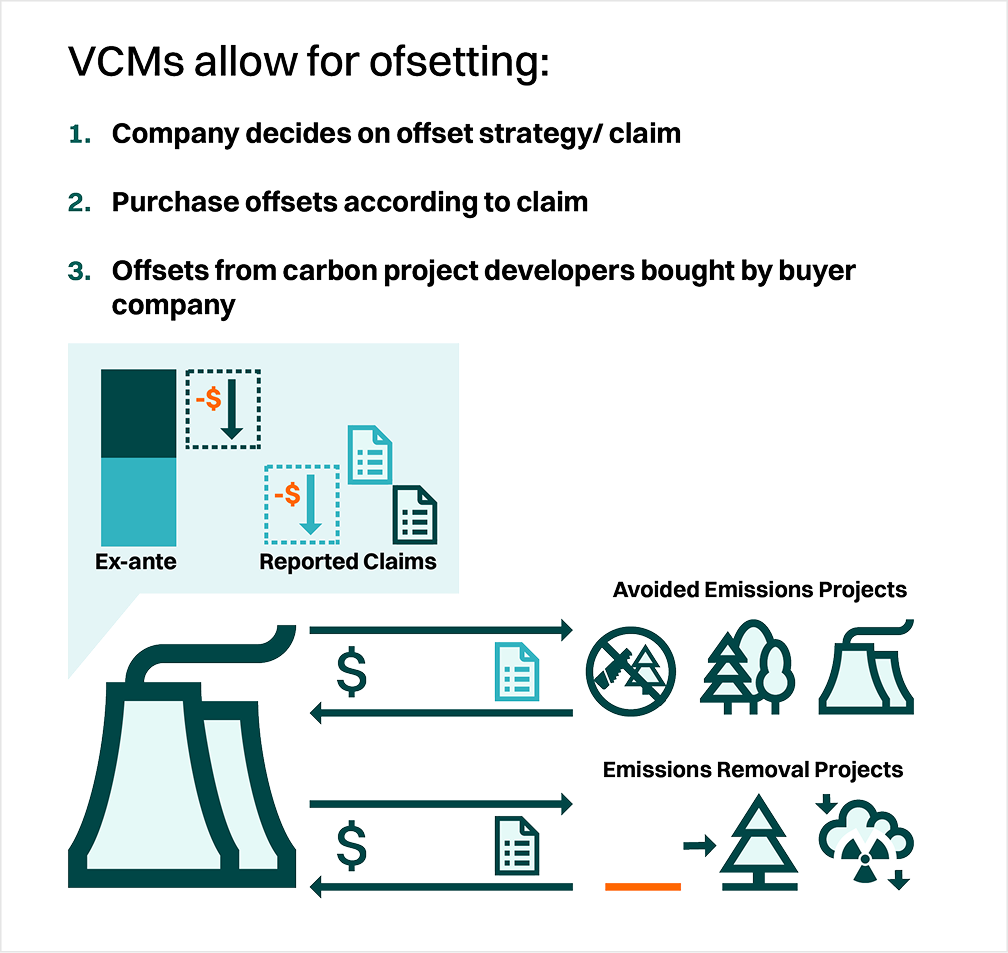

What is the voluntary carbon markets (VCM)?

Voluntary carbon market (VCM) enable companies, investors, and other non-state actors to finance emission reductions or removals on a voluntary basis, outside of government-mandated compliance systems. They provide a mechanism for organisations to take responsibility for emissions, support climate-positive activities, and contribute to national and global climate goals. Ensuring high integrity across the voluntary market is essential to maintain credibility and environmental impact. Integrity must span the supply side, where credits are generated, the demand side, where credits are purchased and used, and the ecosystem, which governs transparency and accountability.

What is demand-side integrity?

On the buy side, the Voluntary Carbon Markets Integrity Initiative (VCMI) provides guidance for companies on how to make credible climate claims based on the responsible use of carbon credits, ensuring that credit use complements and does not replace deep internal emission reductions.

What is supply side integrity?

On the supply side, the Integrity Council for the Voluntary Carbon Market (ICVCM) has established the Core Carbon Principles (CCPs), which define high-integrity criteria for carbon credits, including additionality, permanence, robust quantification, and strong social and environmental safeguards.

Avoiding double counting

Within the ecosystem, integrity depends on robust governance, clear accounting, and safeguards against double counting of emission reductions between voluntary and compliance systems or between host countries and credit buyers. This alignment is critical to ensure that credits represent real and unique climate benefits and that voluntary markets contribute effectively to global decarbonisation efforts.

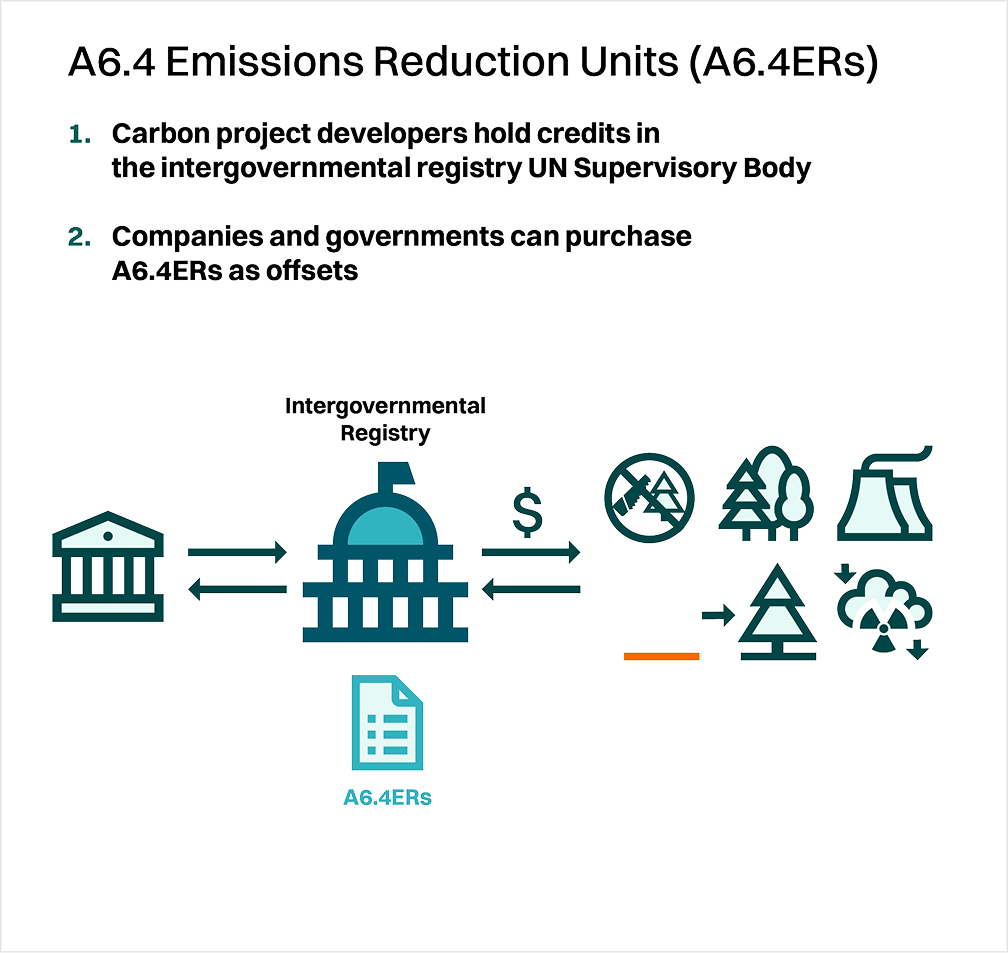

What is the Article 6.4 mechanism?

Article 6.4 of the Paris Agreement establishes a UN-governed mechanism to enable the generation and transfer of high-integrity emission reduction and removal credits between countries and private entities. It builds on the legacy of the Clean Development Mechanism (CDM) under the Kyoto Protocol but introduces stronger safeguards, alignment with countries’ Nationally Determined Contributions (NDCs), and a greater focus on sustainable development.

What is the difference between Article 6.4 and 6.2?

Article 6.4 differs from Article 6.2, which governs bilateral or multilateral cooperative approaches between countries through directly negotiated transfers of mitigation outcomes. While 6.2 provides flexibility for countries to design their own arrangements and track results through corresponding adjustments, 6.4 operates under the authority of the UNFCCC Supervisory Body, which standardises methodologies, accredits activities, and issues credits known as A6.4ERs.

What is the Sustainable Development Tool?

The Article 6.4 mechanism also includes a Sustainable Development (SD) Tool, which helps project developers and host countries assess and demonstrate the social, environmental, and economic co-benefits and impacts of activities registered under the mechanism.

Economic

competitiveness

Nature restoration &

Protection

Social co-benefits

Adaption & Resilience

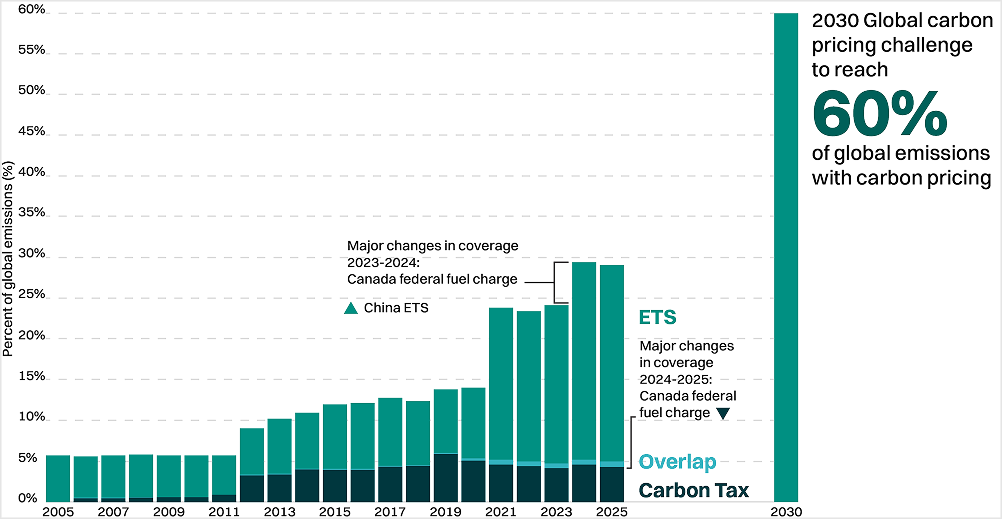

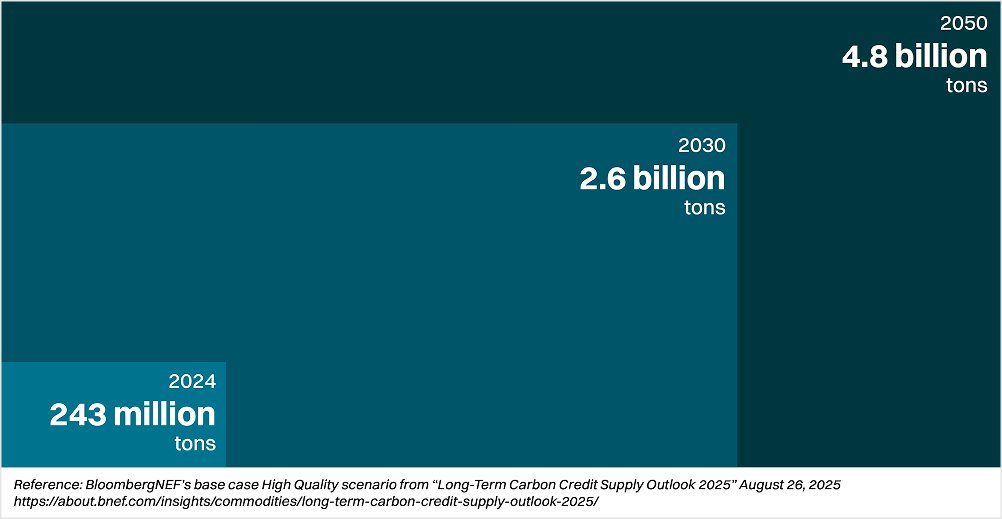

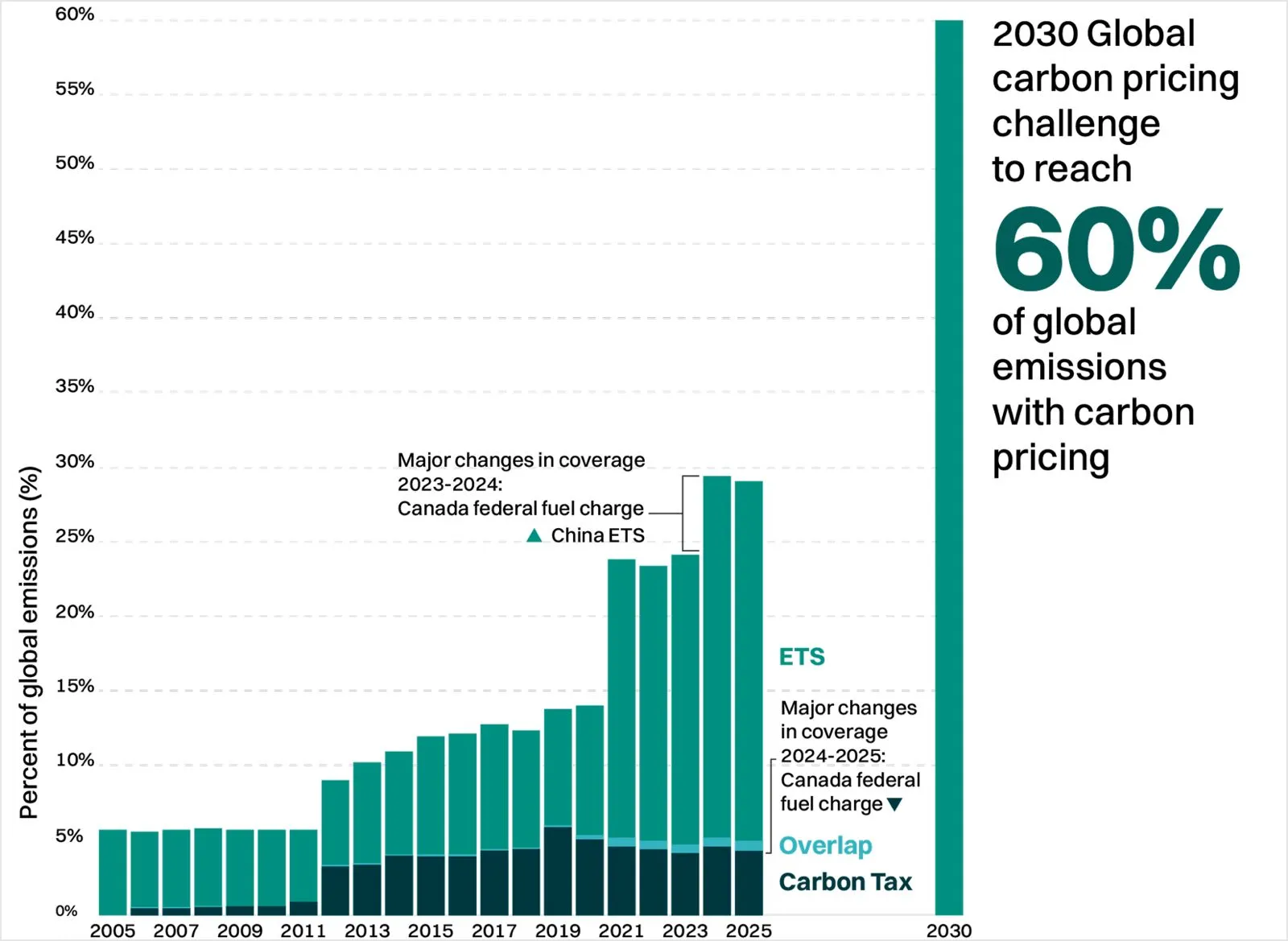

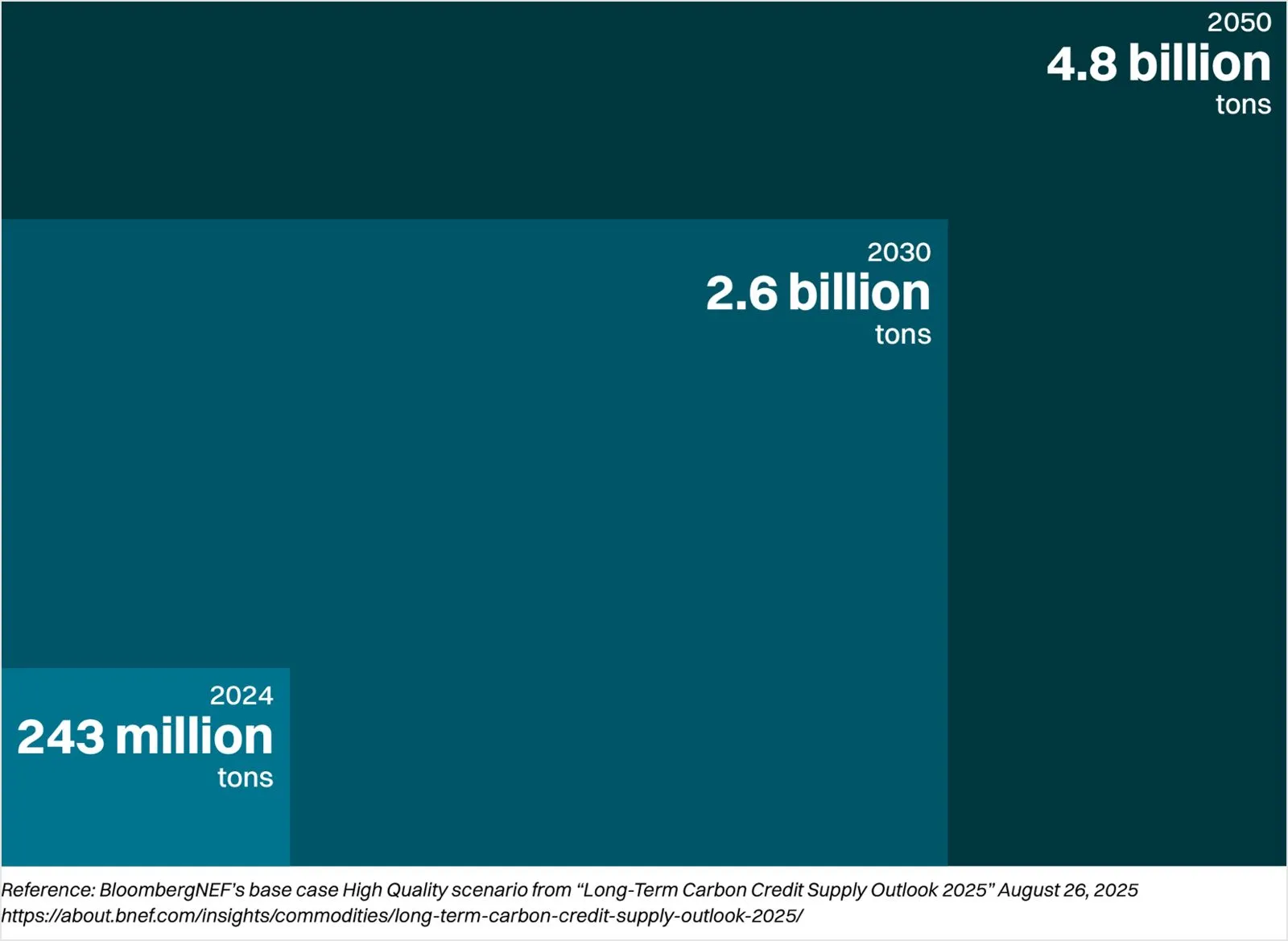

Targeted compliance market expansion

Voluntary carbon market projection

Targeted compliance market expansion

Voluntary carbon market projection

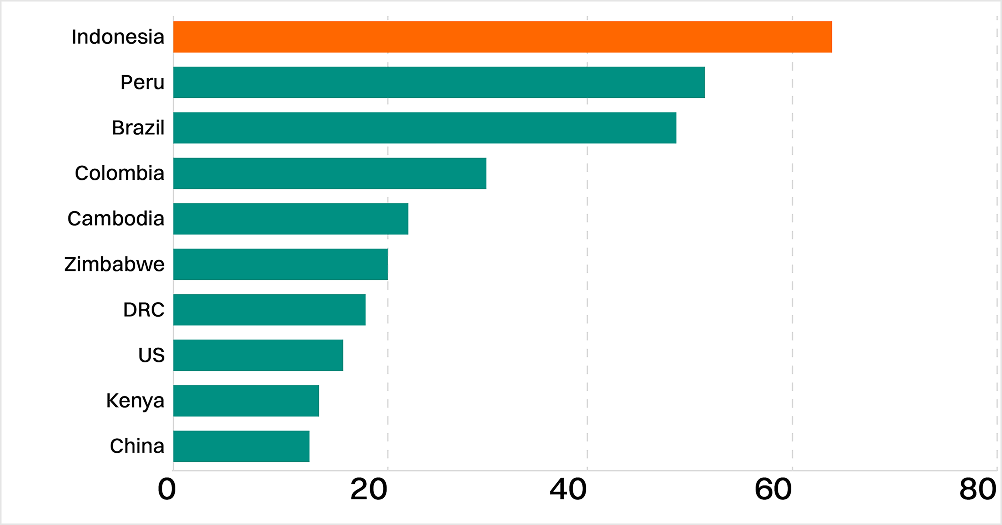

Top Supplier of retired forestry carbon

credits, 2016 – 2025

Reference: BNEF. (2025). “Indonesia Transition Factbook 2025.”

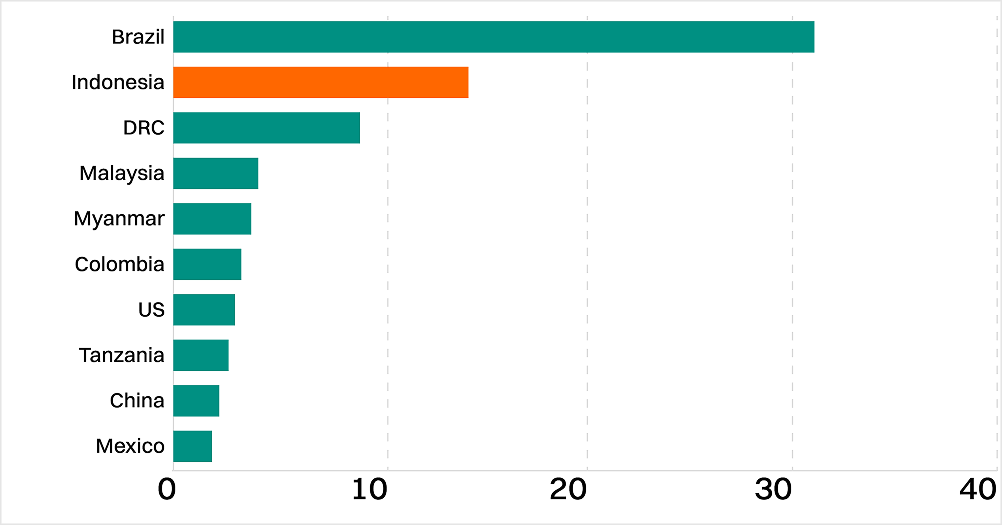

Top Supplier of retired nature-based

carbon credits, 2016 – 2025

Reference: BNEF. (2025). “Indonesia Transition Factbook 2025.”

Green Environment

Let's work together for a green, inclusive and resilient growth for Indonesia

ICGD Secretariat

Wisma Mandiri 2

Jl. Kebon Sirih No.83, RT.2/RW.1, Kb. Sirih, Kec. Menteng, Kota Jakarta Pusat, Daerah Khusus Ibukota Jakarta, 10340

Secretariat@icgdsecretariat.org